However, decentralized exchanges render users much more handle and independence. DEXs don’t infant custody hypertrade aggregator representative property, nor create it lay an amount restriction on the finance that will getting switched. They also offer usage of a wide set of tokens to possess users to swap. They instantly splits and you may paths users’ purchases around the multiple DEXs looking probably the most competitive prices and you may performance model. Playing with an excellent DEX aggregators can offer smaller slippage minimizing trading charge versus exchange using one DEX. One of many benefits associated with DEXs is the highest training out of determinism achieved by using blockchain technical and immutable wise agreements.

Shelter and you can child custody – hypertrade aggregator

Your don’t wanted one personality document prior to exchange inside the a good DEX. Pages regarding the decentralized replace environment manage its crypto tokens. Inside the centralized solutions, the service merchant regulation users’ finance and you can profile. That have a third party with many manage try a two fold-edged sword. For the one hand, when the a person seems to lose their private important factors, the newest replace you may come in handy, and many backups would be set you back let the associate to recover their money.

Must i exchange a comparable cryptocurrencies on the each other CEX and you can DEX?

An excellent decentralized replace (DEX) try an equal-to-fellow system which allows pages in order to trade cryptocurrencies directly from the purses, without needing intermediaries. As opposed to centralized transfers (CEXs), DEXs perform as a result of wise contracts to the blockchain sites, making it possible for pages to retain full power over its possessions. Decentralized exchanges can be regarded as safe than just centralized exchanges in some suggests since the users handle their own crypto assets, and deals are carried out close to the newest blockchain. Since the decentralized transfers are non-custodial, he is smaller prone to hacks you to definitely expose representative financing. Users look after control over their funds, which happen to be kept in their own purses.

That is why DEXs is actually preferred when it comes to confidentiality, however, note that the challenge might improvement in the long term. They do not security financial places, credit cards, or fiat currencies. To obtain to work with a DEX, you should transfer your own fiat to cryptocurrency (to the a great fiat-amicable change) and move you to crypto into your handbag.

Lots of analogous associations are present in the cryptocurrency area, becoming intermediaries so you can pair traders who wish to exchange cash and you can cryptocurrencies, or even one to cryptocurrency for the next. Bitstamp by Robinhood is just one instance of the numerous central transfers constructed on which design. Centralized cryptocurrency transfers are regulated businesses that assists cryptocurrency to find, attempting to sell, and exchange. They act as an intermediary, attempting to provide a safe means to fix hook up users every single most other and as a way to exchange fiat and you can cryptocurrencies.

When looking to help you trade cryptocurrencies, one to oftentimes has to have fun with a move to accomplish this. Centralized of them, your location not completely power over their crypto, or Decentralized of these known as a DEX. Today, we’re bringing a close look for the exactly what an excellent DEX is actually and you can what it will bring for the desk. Really DEXs mostly service cryptocurrency-to-cryptocurrency exchange pairs.

A good decentralized replace try a deck that enables users in order to trading cryptocurrencies personally together without needing a central intermediary. A DEX, otherwise decentralized exchange, is actually a patio you to definitely encourages lead peer-to-peer transactions between cryptocurrency buyers without the need for a main mediator. They works on the blockchain technical and allows profiles so you can exchange tokens securely and you may anonymously. The fresh CEX vs DEX debate relates to manage, comfort, and you can security. Extremely central transfers offer higher liquidity, customer support characteristics, and simple usage of trade pairs, causing them to a strong option for crypto traders who are in need of an excellent simple experience. DEXs, concurrently, offer crypto users complete control of their funds and you can decentralized fund availableness however, wanted far more training to help you navigate.

1inch increased $several million within the 2020 in the a financing round led by the Pantera Financing. Inside later 2021, a leading DEX Uniswap are asking a good 0.05% transaction percentage to your $100,000 trading sampled because of the international accountancy KPMG. CEXs Binance, Coinbase and you may Kraken were billing 0.1%, 0.2% and 0.2%, respectively. In this article become familiar with exactly how an alternative trend from VPNs make use of the blockchain to make sure decentralization and much more.

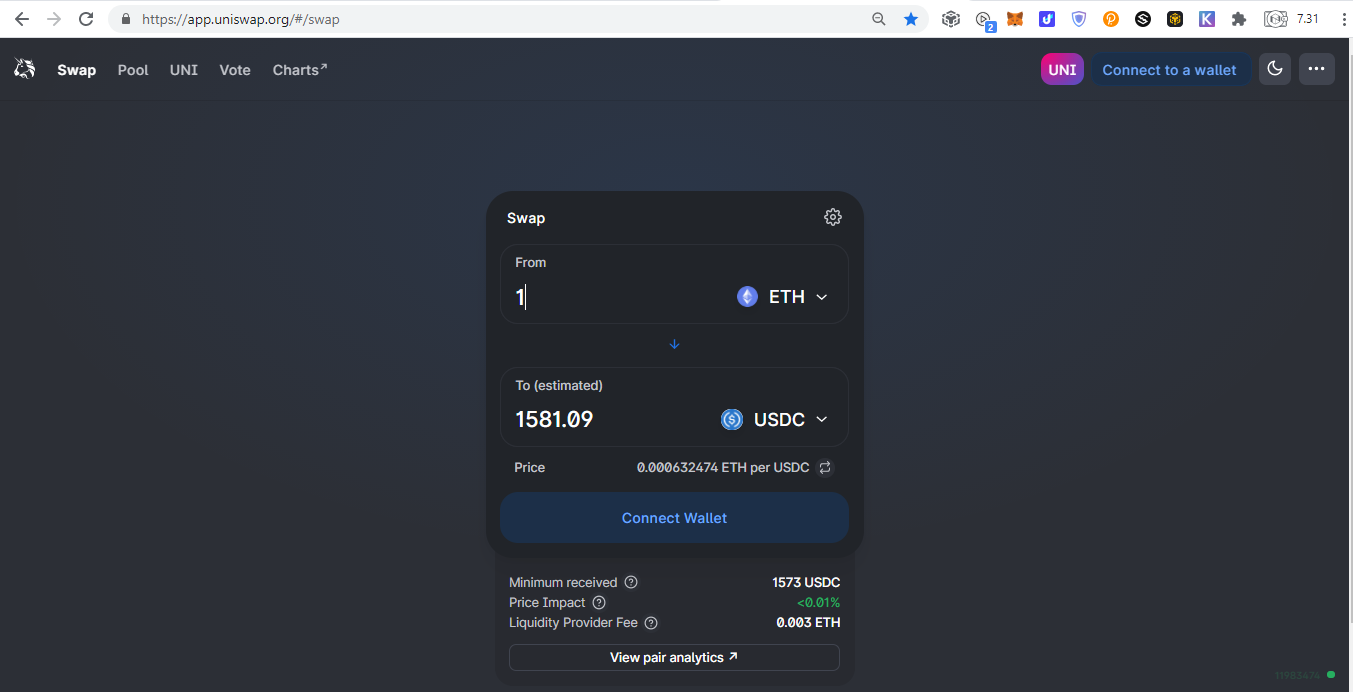

Examples of DEX inside crypto are Uniswap, SushiSwap, and you will PancakeSwap.

Centralized against. Decentralised Crypto Exchanges (CEX vs. DEX)

- Some other advantage of a decentralized replace is censorship-resistance.

- All volume is actually blocked to possess flash investments, in which an investor removes an enormous mortgage to do a leading-frequency exchange and rapidly will pay it back.

- This is going to make DEXs a refuge for privacy-mindful people who worth anonymity and you may wear’t need their monetary interest linked with their identity.

- Central transfers, with all its assets kept in one to put, is primary objectives to have hackers.

Most widely used DEXs now render much easier connects and you can reduced execution, enabling pages to help you change with certainty around the several stores. Exchangeability team earn a percentage away from trading charge, and lots of protocols instantly suits trade activity to optimize earnings. 1inch is actually an excellent DEX aggregator one looks across of a lot DEXs to help you get the best speed for every change.

DEX vs. Central Exchange

You will find a considerable amount of currency moving thanks to cryptocurrency transfers, however it isn’t really nearly as much as you’re led to trust. The majority of people however make use of the traditional financial options we all have been accustomed. So it “county of decentralized exchanges” begins with big cryptocurrency number and you can central transfers, which currently monopolize the market industry. Decentralized transfers is actually building the ongoing future of cryptocurrencies trade, which “state” aims to pave the means having its harsh listing of plans regarding the making. You want to pay attention to him or her because they are framing the brand new way cryptocurrencies change often work in the near future.

Whether or not you’re transferring bucks, euros, or yen, central exchanges get this process seamless. They act as a bridge anywhere between antique fund and also the crypto environment. Although not, DEX networks offer better visibility and you can associate control of fund. Yet not, DEX networks encountered their shelter pressures in the 2023 and 2024. Smart offer exploits for the decentralized exchanges triggered over $eight hundred million within the losses while in the 2023 alone. One of many DEXs to the Solana, named Solution, spends a great decentralized buy publication so that their users to help you trade assets without needing an intermediary to your blockchain.

Learn more about decentralized crypto exchanges and acquire the best alternatives. The first thing that you might search for inside techniques to help you DEXs create needless to say refer to decentralized exchange meaning. DEXs are basically peer-to-peer marketplaces, same as inventory places where cryptocurrency buyers you may perform deals personally. The fresh striking stress out of decentralized transfers is they don’t transfer the duty to the handling of their finance so you can custodians otherwise intermediaries.

To your orderbook DEXs, quite often, the new trade sense is quite the same as central platforms, making onboarding extremely easy. Rather than your order guide, AMMs have fun with something titled liquidity pools. Such pools are created when pages deposit its crypto to the a common pool, and you can deals are made based on a formula one to kits the new price. You could trading when instead looking forward to a purchaser otherwise vendor to suit your order.